The financial industry is using social media as a prominent marketing tool to meet business objectives. For example, many banks and financial institutions have recognised that they can use Twitter and Facebook to deliver exceptional customer service, as queries and complaints can be responded to within minutes.

But when it comes to social media, banks and other financial institutions face some fundamental problems. After the 2008 financial crisis, public trust in banks took a hit. Developing a relationship and earning the trust of consumers online is essential for long term success. However, the Financial Conduct Authority (FCA) has imposed strict regulations regarding the conduct of banks on social media, making it harder for organisations to engage online.

In this post, I’ll examine how certain banks and financial institutions have, despite the strict FCA regulations, still found a way to use social media to good effect, as a means of rebuilding public trust, boosting customer retainment, and forging stronger and more personable relationships with their customers.

Social Media in the Financial Industry – a Vital Part of the Journey

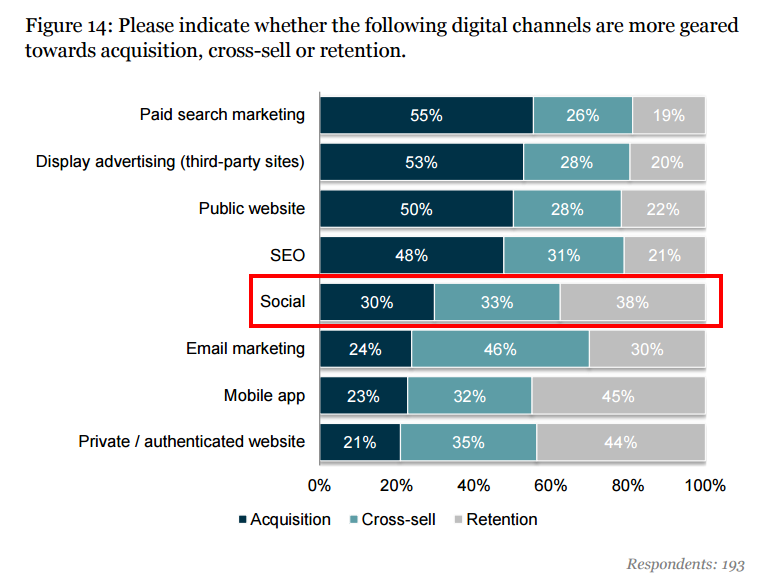

Research from Econsultancy and Adobe found that within the industry, social media plays an important role throughout the customer journey.

The graph below shows how companies in the financial industry use social media as part of their digital marketing strategy. These organisations are focusing their social media efforts to not only perform a customer service role, but to also meet customer acquisition, cross-selling, and retention-related business objectives. This is done by developing and sharing posts that target each stage of the customer journey:

So How Are Financial Institutions Interacting on Twitter?

Twitter allows companies to reach a huge audience and react instantly to events as they happen. Firms can quickly get an idea of how their customers react to new products and services as soon as they’re launched. Many organisations receive so many questions and queries that they operate a separate customer service Twitter account.

NatWest

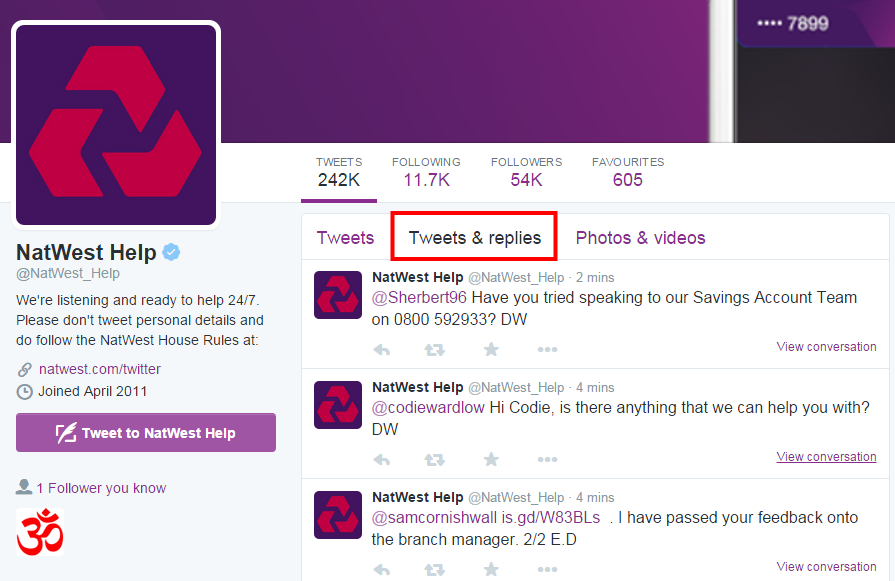

The NatWest Help Twitter account offers helpful banking advice while advertising new products, such as fraud awareness and the new Apple Pay. In compliance with the FCA regulations, their Twitter bio states that users should not tweet their bank details:

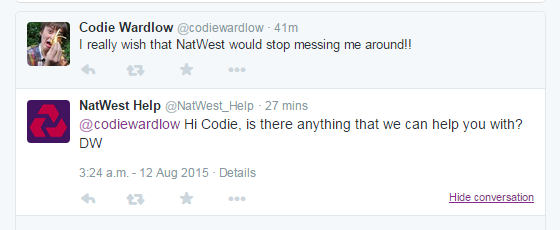

In the tweets and replies feed you can see that NatWest respond to customers within minutes, even when the customer has not tagged NatWest in their tweet. NatWest is clearly using Twitter to build relationships with their clients in a bid to strengthen trust and increase retainment:

Admiral Insurance

Admiral Insurance take a more personable approach to Twitter. Rather than focusing solely on cross-selling and promotion, they have instead adopted a friendly tone, regularly tweeting about charity events, rugby matches, and stories of satisfied customers. Through retweeting genuine and positive tweets from real customers, they create a form of social proof which can help to increase leads:

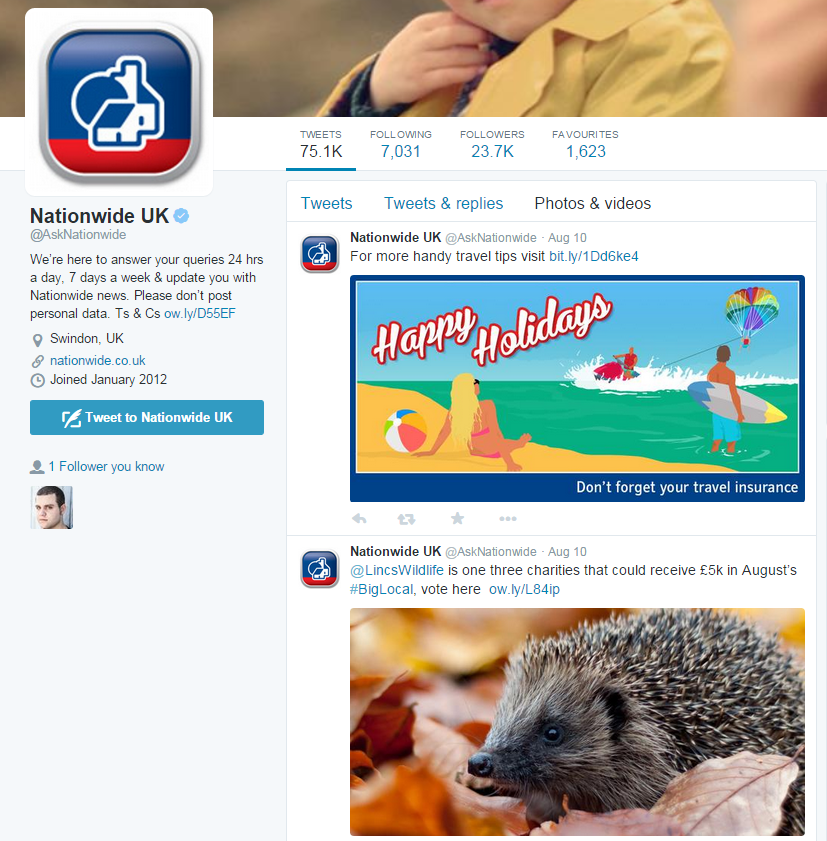

Nationwide

Nationwide focus on maximising Twitter engagement with a focus on bright pictures, cute animals, and charity work. Nationwide mix fun tweets with serious tweets regarding fraud and suspicious activity. They make good use of Twitter by interacting instantly to news reports to reduce concerns, which may help to retain customers:

How Are Financial Institutions Using Facebook?

Facebook allows financial organisations to generate leads, cross-sell and retain their customers through frequent posts and Facebook advertising. Just like on Twitter, financial organisations are using Facebook to provide friendly, helpful, and trustworthy customer service. For example, many organisations have been sharing stories from their charity initiatives in a bid to improve their image in the wake of the 2008 financial crisis.

HSBC

HSBC use Facebook to build a positive relationship with their customers, taking a more personal approach to advertising than is possible with TV or billboards. The engagement levels with HSBC’s most recent posts fluctuates, many posts receive over 1,000 ‘likes’, yet some receive just seven. This proves that understanding what your target audience wants to see on social media is essential if you want to boost likes and shares.

Facebook can give companies a good idea of how the public feels about their products and services. In the case of HSBC, the customer comments can be passionate, and sometimes angry. Improving the public’s opinion through social media is apparently still an on-going task for HSBC:

HSBC target their younger audience using a student specific Facebook page, featuring helpful advice and competitions aimed solely for students. Through developing a strong relationship with this demographic, they may retain students even after they have graduated:

Barclays

Barclays has developed fraud awareness videos to help raise awareness of this serious issue while building public trust in their brand. As each video receives hundreds of likes and shares, their strategy appears to be working. As customers share Barclays helpful video posts with their friends, this campaign may even gain them some new customers:

Social Media in the Financial Industry – What’s Next?

Social media will be essential for all businesses to build relationships and to engage with specific demographics. Improving the customer experience is central to organisations’ success, whether that’s through customer service response on Twitter, or brand development on Facebook.